BRIEF FROM THE CANADIAN REAL ESTATE ASSOCIATION

RECOMMENDATION #1: Allow the deferral of previously written-off depreciation (Capital Cost Allowance) on an investment property when owners sell in order to reinvest.

RECOMMENDATION #2: Index the Home Buyers’ Plan (HBP) to the Consumer Price Index (CPI) in $2,500 increments to ensure it never loses its purchasing power.

EXECUTIVE SUMMARY

Canada’s economy faces increasing headwinds. REALTOR® proposals for Budget 2012 would create a policy environment to help sustain Canada’s economic recovery. These two fiscally responsible recommendations provide first-time home buyers and investment property owners with critical tools to invest in Canada’s economy.

A number of studies have shown real estate transactions create jobs and economic growth in a number of sectors. Research from Altus Group estimates between 2008 and 2010 residential Multiple Listing Services® (MLS®) housing transactions created $19 billion in spin-off activity and over 155,000 jobs annually. A second Altus Study of multi-unit income property transactions in three of Canada’s largest cities found the typical sale generated $287,850 in ancillary spending.

Real estate buyers often undertake renovations and purchase new appliances and furnishings. In addition, real estate transactions generate revenue for professionals involved in the transaction, as well as government through the collection of taxes and fees.

The Canadian Real Estate Association (CREA) forecasts national resale housing activity for 2011 and 2012 to be close to the ten-year average. In addition, housing prices in 2012 are expected to be on par with 2011 levels.

Although Canada’s housing market is currently in balance, both the housing market and the economy remain vulnerable. Budget 2012 is an opportunity to maintain the strength of Canada’s economic recovery through increased investment.

STIMULATE COMMUNITY REINVESTMENT

Allowing income property owners to defer previously written-off depreciation (Capital Cost Allowance) would remove a major obstacle impeding community reinvestment. Many investors hold on to properties because of the tax consequences triggered by selling.

Tax deferral would level the playing field between large and small investors, and unleash a chain reaction of economic and community benefits.

The cost of this proposal is offset by the collection of other revenue.

OPEN THE DOOR TO HOMEOWNERSHIP

Indexing the Home Buyers’ Plan (HBP) to the Consumer Price Index (CPI) in $2,500 increments would prevent the steady erosion of its value. At the same time, incremental indexation would allow for implementation after balanced budget targets have been reached. Indeed, this proposal would cost nothing until 2015, at which point the cost would be minimal.

The HBP creates jobs, generates economic growth, and is a gateway to financial security for Canadian families.

REAL ESTATE ECONOMIC OUTLOOK

Weaker than expected economic growth in the second quarter of 2011 has lowered Canadian forecasts. While growth is widely expected to rebound in the second half of the year, economic headwinds have increased and may prompt further downgrades to Canadian growth forecasts.

In response to the Bank of Canada’s July Monetary Policy Report, private sector economists believe bank rate hikes may take place later than previously anticipated and rise by less than previously expected, depending on the persistence and severity of the economic headwinds.

Low interest rates have supported housing activity and prices. Overall, sales activity and price gains remained stronger than expected in the second quarter of 2011. Home sales also had better than expected momentum heading into the third quarter. As a result, CREA raised its forecast for national sales activity and average price in 2011.

National sales activity is now expected to reach 450,800 units in 2011, up less than one per cent from levels in 2010. CREA had previously forecast a 1.3% decline in activity in 2011. Deteriorating affordability has led to a small downgrade to the outlook for sales activity in 2012.

National sales activity in 2012 is forecast to remain largely even with expected 2011 levels, edging down 0.7% to 447,700 units. Forecasts for 2011 and 2012 put sales activity roughly on par with its ten-year average.

The national average home price is forecast to rise 7.2% in 2011 to $363,500. This is an upward revision to CREA’s previous forecast published in May 2011, and reflects strong price growth in Vancouver and Toronto during the second quarter of 2011.

The national average price is expected to moderate in the second half of the year as elevated sales activity in some of Canada’s more expensive housing markets returns to more normal levels.

Prices are expected to stabilize in 2012 at $363,600, holding steady with the 2011 level, but at a slightly higher level than CREA previously forecast.

STIMULATE COMMUNITY REINVESTMENT

RECOMMENDATION #1: Allow the deferral of previously written-off depreciation (Capital Cost Allowance) on an investment property when owners sell in order to reinvest.

Allowing income property owners to defer previously written-off depreciation (Capital Cost Allowance (CCA)) is a fiscally prudent approach that would remove a major obstacle impeding community reinvestment, level the playing field for small investors, and generate economic and job growth.

Income property investors face taxation on CCA when they sell, and are often left with insufficient funds after tax to acquire a property of similar value. Consequently, many hold on to properties instead of reinvesting in the community.

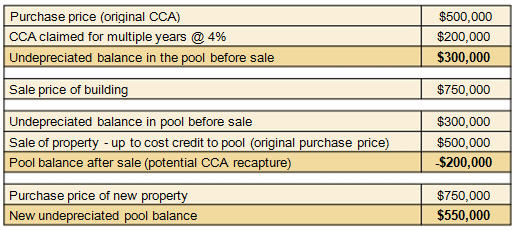

The CCA system allows income property owners to write off a fixed percentage of the original cost of a building and its component parts each tax year. Up to four per cent of the undepreciated balance can be claimed against net rental income each year.

Each rental property is currently treated separately for CCA purposes, if it was acquired after 1971 at a cost of more than $50,000. This means the sale of a single building triggers a recapture of the previously claimed depreciation (CCA), which results in insufficient cash resources after tax to facilitate reinvestment. However, if income properties held by a particular owner were pooled together for depreciation purposes, the recapture of CCA could be deferred, and proceeds that would otherwise be taxed could be used for reinvestment.

Under this system, any sale would reduce the pool balance and resulting amount available to depreciate, and any purchase would increase it. In addition, any deferral would be recaptured when the pool balance goes below zero, encouraging income property owners to reinvest and grow their portfolios.

Example

An added benefit of the pooling system is that by combining multiple properties into a single pool, the tax system is streamlined for compliance and administration.

LEVEL THE PLAYING FIELD

This is a Main Street proposal that helps level the playing field between large and small real estate investors. Because real estate developers are regarded for tax purposes as actively engaged in the business of real estate and therefore not subject to the rental loss restriction that smaller investors must comply with, the Income Tax Act provides developers with a mechanism to shelter CCA recapture when reinvesting. This tax advantage allows developers to write down the amount of the CCA recapture against the CCA balance of the replacement property immediately, effectively creating a pooling effect to defer tax.

Over half of the individuals who would benefit from this policy change have net incomes below $50,000. The example above illustrates the power of the pooling system for these small investors. An investment property owner earning $50,000 a year would have over $90,000 preserved for reinvestment, so long as they maintain a positive pool balance by purchasing another property before the end of the tax year.

ECONOMIC ACCELERATION

This proposal would help industries still recovering from the global economic recession by creating jobs and generating economic growth.

Indeed, Altus Group found a typical multi-unit income property transaction in the Greater Toronto Area (GTA), Greater Vancouver Area (GVA), or Greater Calgary Area (GCA) generates $287,850 in spin-off spending. This includes renovations, repairs, professional fees, and revenue for all levels of government.

The Altus research also estimates every two transactions create more than one job.

By making real estate a more viable investment vehicle, this proposal would provide additional choice for Canadians saving for retirement, as well as retirees dependent on regular income. It would also enable real estate investment portability where a household wishes to relocate its property holdings to correspond with a move to another city, as it can with a stock or bond portfolio.

COMMUNITY REVITALIZATION

Renovations typically occur after a sale when new owners reposition their property to attract new tenants and reduce operating costs. This proposal would encourage owners holding on to older buildings strictly to avoid CCA recapture to sell.

Renovations would also make buildings more energy efficient. In fact, buildings account for 39 per cent of U.S. carbon emissions and Canadian figures are similar. A study identified 1,000 buildings in the GTA that consume as much as 20 per cent more energy per square metre than a typical single family home. Retrofitting could cut energy use and carbon output in these buildings by over 50 per cent.

A FISCALLY PRUDENT APPROACH

The cost of the proposal will be offset considerably by the collection of other associated revenue. This includes collection of Capital Gains Tax, which is also triggered by a property sale, and GST/HST and income tax from spin-off activity.

In addition, since the otherwise recaptured CCA reduces the balance available for depreciation in the pool, more revenue would be collected in future tax years than under the current CCA system. In the example of the pooling system on page 3, after selling and reinvesting in another property, the investor has an undepreciated pool balance of $550,000, enabling them to depreciate just $22,000 in the next tax year. Under the current CCA system, the investor would have paid tax on the CCA recapture and started off with a higher undepreciated pool balance, $750,000, enabling them to depreciate $8,000 more, or $30,000, in the next tax year.

In addition, all deferred CCA is ultimately collected when an investor’s pool balance goes below zero by choosing not to reinvest.

CREA is working with a leading economist to determine the specific budgetary impact and will report the results to the Committee; however, it is worth noting that a sale triggered by this policy change would result in Capital Gains Tax payable to the government, along with GST/HST and income tax from spin-off activity.

OPEN THE DOOR TO HOMEOWNERSHIP

RECOMMENDATION #2: Index the Home Buyers’ Plan (HBP) to the Consumer Price Index (CPI) in $2,500 increments to ensure it never loses its purchasing power.

The Home Buyers’ Plan (HBP) RRSP withdrawal limit needs to keep pace with inflation to stop the steady erosion of its purchasing power and protect its value for first-time home buyers. While this was recognized in Budget 2009, which increased the plan’s withdrawal limit from $20,000 to $25,000, inflation has begun to erode the plan’s buying power again. In order to preserve the plan’s value for tomorrow’s first-time home buyers, it needs to be indexed to inflation.

Indexing the HBP to the CPI in $2,500 increments would delay implementation until after balanced budget targets have been met. Indeed, there is no cost until 2015, at which point the cost would be minimal.

A UNIQUE AND VITAL PROGRAM

The HBP has made homeownership a more affordable reality for over two million Canadians. It allows Canadian families to save concurrently for retirement and a home, eliminating the need to choose one over the other or greatly dilute both goals. It is an essential and unique tool in a home buyer’s toolkit.

The HBP provides a gateway to financial security through homeownership. In fact, average household net worth was found to be $11,000 for those who rent compared to $375,000 for homeowners with mortgages and $764,000 for mortgage-free homeowners.

Furthermore, the HBP effectively serves as a repayable zero-interest self-loan, which can reduce or eliminate the need for costly mortgage insurance and reduce the amount of interest paid to lenders.

BENEFITS WORKERS AND INDUSTRIES

According to Altus Group, each MLS® home sale and purchase generates an average of $42,350 in ancillary spending. This includes renovations, furniture and appliances, professional services, moving costs, and tax revenue to government.

In 2009, more than 50,000 homes were purchased using the HBP, resulting in over $2.1 billion in spin-off spending and over 17,500 jobs.

INDEXATION IS AN ESTABLISHED PRACTICE

A number of programs are indexed to ensure they do not lose their intended value, including retirement benefits, Registered Retirement Savings Plans, and Tax Free Savings Accounts.

Tax Free Savings Accounts are indexed to the Consumer Price Index and rounded to the nearest $500. The HBP should be indexed in a similar way.

ZERO COST UNTIL 2015

Using Budget 2009 as a starting point, indexing the HBP in $2,500 increments would enable the government to meet its deficit reduction targets and other planning objectives. This approach would cost nothing until 2015, at which time the plan would adjust by $2,500 at a cost of $7.5 million. A further $2,500 increase would occur in 2020 at an additional cost of $7.5 million. This costing is based on estimates contained in Budget 2009 and 2010.